How I Almost Lost Everything Inheriting Property – And What I Learned

Inheriting a family home felt like winning the lottery—until I realized it came with hidden financial traps. I thought ownership meant freedom, but instead, I faced taxes, legal confusion, and family conflict. What started as a blessing nearly became a financial disaster. This is my story of navigating property inheritance the hard way, and the wealth management lessons that saved me. If you're facing something similar, you’re not alone—and there’s a smarter path forward. The emotional pull of a family home can be overwhelming, but without careful planning, even the most valuable inheritance can become a burden rather than a benefit. Recognizing this early on could mean the difference between building long-term wealth and losing it all.

The Emotional Weight of Inheriting Property

Owning a home passed down from family carries deep sentimental value. For many, it represents more than bricks and mortar—it's a living memory, a place where holidays were celebrated, children grew up, and generations gathered. When I inherited my parents’ house, I was flooded with emotion. Every room held a story. The kitchen still smelled faintly of my mother’s baking, and the creak in the third stair reminded me of late-night conversations with my father. It felt sacred, almost untouchable. That emotional attachment, while beautiful, quickly became a barrier to sound financial decision-making.

What I didn’t realize at the time was how powerfully feelings can distort judgment. I assumed keeping the house was the right thing to do—not because it made financial sense, but because it honored my parents’ legacy. I avoided consulting financial advisors, postponed tax planning, and delayed crucial decisions about ownership and use. I told myself I was being respectful, but in truth, I was avoiding discomfort. Many heirs make the same mistake: they let grief, nostalgia, or guilt override logic. The result? Missed opportunities, mounting costs, and strained family relationships. Recognizing the emotional weight of inherited property is not about dismissing those feelings—it’s about acknowledging them so they don’t control your choices.

Financial advisors often emphasize the importance of separating emotion from asset management, and for good reason. When emotions dominate, decisions tend to be reactive rather than strategic. For instance, refusing to sell a home because it holds memories may prevent you from investing in a more stable or higher-yielding asset. Alternatively, impulsively selling out of stress or conflict can lead to poor timing and lower returns. The goal isn’t to erase sentiment but to create space between feeling and action. Taking time to grieve, seeking support from counselors or trusted friends, and setting a timeline for decisions can help maintain clarity. In my case, waiting six months before making any major moves allowed me to approach the situation with more balance and foresight.

Hidden Costs That Catch Heirs Off Guard

When people inherit property, they often focus on its market value and overlook the ongoing expenses that come with ownership. I certainly did. I saw the house as an asset, not a liability. But within months, I began receiving bills that I hadn’t anticipated. Property taxes, which had been covered under my parents’ estate, now fell to me. The annual amount was more than I expected, especially since the tax assessment had increased after the transfer of ownership. Then came the insurance premiums, which had risen due to the home’s age and location. These recurring costs alone totaled thousands of dollars per year—money that wasn’t generating any return.

But the real shock came when the roof began leaking during a heavy storm. A contractor’s inspection revealed that the entire structure needed replacement, costing nearly $15,000. At the same time, an electrical inspection flagged outdated wiring that didn’t meet current safety codes. Bringing the system up to standard would require another $8,000. These were not optional repairs—they were urgent. I had no emergency fund set aside for such expenses, and I hadn’t considered that an inherited home might need significant capital investment just to remain habitable. Many heirs assume that owning property means stability, but the reality is that real estate can quickly become a financial drain if maintenance is neglected.

Beyond repairs and taxes, there were also municipal fees, utility bills, and potential landscaping costs if the property was to be kept in good condition. If the home was vacant, I had to pay for security, pest control, and regular check-ins to prevent damage. Some of these costs could have been offset if I had decided to rent the property, but that would have required additional upgrades, tenant screening, and time spent managing the unit. The idea of passive income from rental property often overlooks the active effort and capital it demands. What I learned the hard way is that inherited real estate is not a windfall—it’s a responsibility. Before deciding to keep a home, heirs should conduct a full cost assessment, including projected maintenance, tax obligations, insurance, and opportunity costs.

Tax Traps and Legal Complexities

One of the most underestimated challenges of inheriting property is understanding the tax implications. In many regions, inheritance itself may not be federally taxed, but capital gains tax can become a major factor when the property is eventually sold. I didn’t realize this until a year after taking ownership, when I consulted a tax professional out of concern about rising expenses. She explained the concept of stepped-up basis—the rule that resets the property’s value to its market price at the time of the owner’s death, which can reduce capital gains liability. This was critical information, but I had already missed opportunities to document the valuation properly.

Additionally, some states impose inheritance or estate taxes on high-value properties, especially when passed to non-spousal heirs. These taxes can take a significant portion of the net proceeds, particularly if the estate exceeds certain thresholds. Because I didn’t seek advice early, I nearly missed filing deadlines and risked penalties. The lesson here is clear: consult a qualified tax advisor as soon as possible after inheritance. They can help determine your tax exposure, guide documentation, and suggest strategies to minimize liabilities, such as timing the sale or transferring ownership gradually.

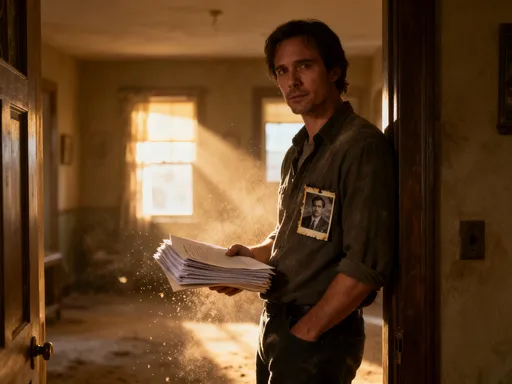

Legal complexities add another layer of difficulty. Probate—the legal process of validating a will and distributing assets—can take months or even years, depending on the jurisdiction and whether disputes arise. In my case, the will was clear, but the deed transfer required multiple forms, notary appointments, and county recordings. Without professional guidance, I might have made errors that delayed ownership or created title issues. Worse, unclear titles can prevent financing, insurance, or sale down the line. Ensuring that all legal documents are properly filed and that the chain of title is intact is essential. This includes obtaining death certificates, updating property records, and confirming that liens or mortgages have been settled.

Another risk is co-ownership confusion. If multiple heirs inherit the property, each has a legal claim, but without a formal agreement, disagreements can escalate. One sibling might want to sell, another to rent, and another to live in the home—without a written plan, these differences can lead to legal disputes. Courts may become involved, increasing costs and emotional strain. To avoid this, families should establish a clear ownership structure early, whether through buyout agreements, rental arrangements, or timelines for sale. Legal counsel can help draft binding documents that protect everyone’s interests.

Family Dynamics and Financial Conflict

Perhaps the most painful aspect of inheriting property isn’t financial—it’s relational. Money and emotion mix poorly, and when family members have different visions for an inherited home, tensions rise quickly. In my family, the house became a source of division rather than unity. One sibling saw it as a financial asset and wanted to sell immediately to split the proceeds. Another viewed it as a vacation retreat and proposed keeping it for family gatherings. I was torn between honoring our parents’ memory and making a practical decision. These differing perspectives, while understandable, created resentment and misunderstandings.

What made the situation worse was the lack of communication. We avoided direct conversations, hoping someone else would take the lead. Assumptions were made, feelings were hurt, and passive-aggressive comments began to surface during holiday calls. The longer we waited, the harder it became to reach consensus. Financial conflict in families often stems not from greed, but from unspoken expectations and unequal emotional attachments. Some heirs feel entitled to more because they lived nearby or provided care, while others believe equal division is fair regardless of contribution. Without transparency, these imbalances fuel conflict.

We eventually brought in a neutral third party—a financial mediator recommended by our attorney—to facilitate a discussion. We laid out our goals, concerns, and financial situations. It became clear that none of us could afford to buy out the others, and maintaining the property jointly wasn’t feasible. We agreed to list the home for sale, with proceeds divided equally after expenses. While it wasn’t the outcome anyone had idealized, it was fair and practical. The experience taught me that wealth transfer is as much about relationships as it is about assets. Open dialogue, active listening, and professional support can prevent lasting damage to family bonds.

To avoid similar conflicts, families should initiate conversations about inheritance before it happens. Parents can clarify their wishes in estate plans, and siblings can discuss their values and expectations. If a property is to be inherited, consider whether all heirs want it, can afford it, and agree on its use. Written agreements, even informal ones, can prevent misunderstandings. Recognizing that fairness doesn’t always mean equality—and that emotional value differs from financial value—can help families navigate these decisions with compassion and clarity.

The Risk of Holding On Too Long

One of the most common financial mistakes heirs make is delaying action out of sentiment. I waited two full years before listing the house, believing that time would help me decide. But indecision came at a cost. During that period, property values in the area peaked and then declined due to market shifts. I eventually sold for less than the high point, missing out on tens of thousands of dollars in potential proceeds. Meanwhile, I continued to pay taxes, insurance, and maintenance—expenses that eroded the home’s net value. Holding on too long turned a valuable asset into a depreciating one.

The real cost wasn’t just financial—it was opportunity cost. The money tied up in the house could have been reinvested in diversified assets like mutual funds, retirement accounts, or education savings. Instead, it sat idle, losing value to inflation and upkeep. Financial planners often stress the importance of liquidity and asset allocation, yet many heirs treat inherited property as untouchable, deferring decisions indefinitely. This hesitation can prevent wealth growth and increase vulnerability to market downturns.

There’s no universal timeline for what to do with inherited property, but delaying without a clear strategy is risky. A structured approach can help: set a decision deadline, consult professionals, evaluate options (sell, rent, occupy), and assess personal financial goals. If keeping the home aligns with your long-term plan and you can afford the costs, it may be the right choice. But if it’s being held for emotional reasons alone, it’s worth asking whether the sentimental value outweighs the financial burden. In my case, selling allowed me to redirect funds toward goals that mattered more—financial security, retirement, and my children’s future.

Smart Wealth Management After Inheritance

Once the property is settled—whether sold, rented, or retained—the focus should shift to long-term wealth management. The proceeds from an inheritance, if handled wisely, can significantly improve financial stability. After the sale of the house, I worked with a financial advisor to create a personalized plan. We reviewed my income, expenses, debts, and future goals. Instead of spending the money impulsively, I committed to using it strategically. A portion went into a diversified investment portfolio, another into a retirement account, and a third into a college fund for my children. This approach ensured that the inheritance served my family’s future, not just my past.

One of the most important principles I learned is diversification. Putting all your wealth into a single asset—especially real estate—increases risk. If property values drop, your entire net worth can be affected. By spreading investments across stocks, bonds, and other vehicles, you reduce exposure to market volatility. My advisor emphasized that even if I had chosen to keep the house, I should have balanced it with other assets to maintain financial resilience. Diversification isn’t about eliminating risk—it’s about managing it wisely.

Another key step was setting clear financial goals. Without a plan, money can disappear quickly, even large sums. I defined specific objectives: paying off high-interest debt, building an emergency fund, and funding long-term savings. Each decision was aligned with these goals, which helped me stay disciplined. I also established automatic transfers to investment accounts, ensuring consistent growth over time. These habits transformed the inheritance from a one-time windfall into a foundation for lasting security.

Working with professionals made a critical difference. A certified financial planner helped structure my investments, a tax advisor ensured compliance and optimization, and an estate attorney assisted with updating my own will. These experts didn’t make decisions for me—they empowered me with knowledge. Their guidance helped me avoid common pitfalls and build a plan tailored to my life stage and responsibilities. For anyone navigating inheritance, seeking professional support isn’t a luxury—it’s a necessity.

Building a Legacy Without the Burden

True wealth management isn’t just about preserving money—it’s about using it with intention. Inheriting property can be a turning point, not just financially, but personally. My experience reshaped how I view money. I no longer see it as something to hold onto out of fear or sentiment. Instead, I see it as a tool—to protect my family, support my goals, and create opportunities for future generations. The house is gone, but the lessons remain. I now approach financial decisions with greater clarity, discipline, and purpose.

For others facing inheritance, the path doesn’t have to be as difficult. By recognizing emotional influences, understanding hidden costs, navigating tax and legal issues, managing family dynamics, avoiding delays, and planning strategically, you can turn a complex situation into a source of strength. The goal isn’t to eliminate sentiment, but to ensure it doesn’t override sound judgment. A family home can be honored in ways beyond physical ownership—through stories, traditions, and the responsible use of its value.

Ultimately, building a legacy isn’t about holding on to property—it’s about making choices that reflect your values and secure your future. Whether you sell, rent, or keep an inherited home, do so with awareness and intention. Let the experience teach you, guide you, and empower you. Because real wealth isn’t measured in square footage or market value—it’s measured in peace of mind, security, and the ability to face the future with confidence.