More Than Alerts: How Spending Reminder Apps Brought Our Family Closer Together

Have you ever argued with your partner about an unexpected bill? Or watched your teen blow their allowance in two days? I’ve been there—until we started using spending reminder apps as a family. It wasn’t just about saving money. It changed how we communicate, plan, and support each other. What began as a simple tool for budgeting slowly became a quiet force that brought us closer, saved us time, and reduced daily stress. These little notifications didn’t just help us track where our money went—they helped us feel more in control, more connected, and honestly, a little more like a team.

The Messy Reality of Family Finances (And Why We Needed Help)

Let’s be honest—money talk at home can feel like walking on eggshells. I remember one evening, just before bedtime, when my husband opened a credit card statement and said, 'Wait, did you know we’re paying $15 a month for that art streaming service?' I blinked. 'What art service?' He showed me the charge. It turned out I had signed up during a free trial months ago and completely forgot to cancel. It wasn’t a huge amount, but the look on his face said it all: disappointment, frustration, and that quiet question—'Why didn’t you tell me?' That moment wasn’t really about $15. It was about trust, communication, and the invisible weight of financial oversight.

Our family wasn’t careless. We both worked full-time, paid bills on time (mostly), and tried to save. But little things kept slipping through—like my daughter’s summer camp deposit due two weeks early, or the car insurance renewal that came two months sooner than expected. There were no big crises, but a constant low hum of anxiety. 'Did we pay that?' 'Is this charge familiar?' 'Why does this month feel tighter than last?' We weren’t fighting over money, but money was quietly straining our connection. We needed a system, not more willpower.

What I’ve learned since is that this is incredibly common. So many families I’ve talked to—friends at school pickup, neighbors at community events—share the same story. We love each other, we want to do well, but money feels too emotional, too loaded to bring up casually. We avoid it until something goes wrong. And when it does, it’s not just about the dollars—it’s about the missed connection, the lost peace, the extra mental load each of us carries. That’s when I realized: our problem wasn’t bad money habits. It was a lack of shared awareness. We were all trying to manage pieces of the puzzle without seeing the whole picture.

Discovering Spending Reminder Apps: A Small Tool With Big Potential

I didn’t set out to fix our family dynamics. I just wanted to stop missing payments. One afternoon, while organizing my phone, I noticed an alert from a banking app: 'Your gym membership renews in 3 days—$79.' I hadn’t even thought about it, but there it was, clear and kind. No judgment, just a heads-up. That tiny message made me wonder—what if we could have that for everything? Not just bills, but allowances, savings goals, even grocery shopping?

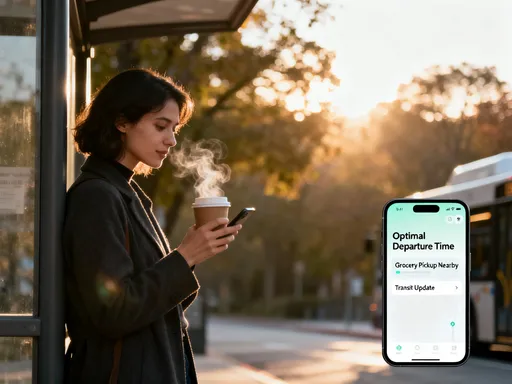

That’s how I started exploring spending reminder apps. I wasn’t looking for anything fancy—no spreadsheets, no complicated graphs. I wanted something simple, something we could all use without feeling like we were being watched or judged. What I found was surprisingly gentle. These apps don’t control your spending. They don’t scold you for buying coffee. Instead, they work like a thoughtful friend whispering, 'Hey, just a reminder—the library books are due tomorrow,' or 'Your daughter’s music lesson fee is due this Friday.'

The first one I tried was a shared family account with customizable alerts. I set up reminders for our major bills—electricity, internet, phone—so they’d pop up five days before due. Then I added smaller things: my son’s weekly soccer snack duty, my own prescription refill, even our monthly coffee subscription. The real test came when I invited my teenage daughter to join. I expected eye-rolling. Instead, she said, 'Wait, you can remind me when my allowance runs low?' That was the moment I knew this could work. It wasn’t about control. It was about care. She didn’t feel policed—she felt supported. And for the first time, money wasn’t just a silent stressor. It was something we could talk about, together.

From Chaos to Coordination: How Alerts Reshaped Our Routine

Before the app, our weekends often started with a familiar ritual: 'What do we need to pay this week?' 'Did the water bill go out?' 'Is anyone low on cash?' It wasn’t dramatic, but it ate up time—time we could have spent hiking, baking, or just relaxing. Now, Sunday evenings feel different. We still gather in the kitchen, but instead of scrambling, we open the app and review the week ahead. It’s become part of our rhythm, like checking the weather or planning meals.

The change wasn’t overnight, but the difference is real. Last month, my husband had a work trip during our usual grocery day. In the past, that would have meant either last-minute panic shopping or eating cereal for dinner. This time, I got a reminder on Thursday: 'Family grocery budget update—$85 remaining.' I checked the list we’d shared in the app, adjusted a few items, and ordered ahead. No stress, no arguments. The app didn’t make the decision for me—it just gave me the information I needed, when I needed it.

Another big shift was in how we handle our kids’ allowances. We used to hand over cash on Fridays, and by Sunday, it was often gone—sometimes on things they didn’t even remember buying. Now, each child has a small digital allowance tracked in the app. They get a notification when it’s deposited and another when it’s below 20%. My son started asking, 'Can I save this week to buy the new soccer ball next month?' That kind of forward thinking never happened before. The app didn’t teach him patience—it just made the consequences visible. And because we could all see the same information, there was no 'I didn’t know' or 'You said I could spend it.'

Even our bill payments transformed. No more frantic late-night transfers or overdraft fees. The app sends alerts three times: one week before, three days before, and the morning of. We’ve set up automatic payments for fixed bills, but the reminders keep us informed. It’s not about doing less—it’s about doing it with more clarity. And that clarity has created space. Space to breathe, to plan, to actually enjoy our weekends instead of dreading the financial to-do list.

Talking About Money Without the Tension

One of the most unexpected benefits was how the app changed our conversations. Money used to be this landmine topic—safe to avoid, dangerous to bring up. Now, it’s part of our everyday chat. The app became a neutral third party, like a referee who doesn’t take sides. Instead of 'You forgot to pay the internet bill,' it’s 'The app reminded us yesterday—should we split it this time?' That small shift in language made a huge difference. It wasn’t about blame. It was about teamwork.

I remember one evening, my daughter said, 'Mom, the app says I only have $12 left from my allowance. Can I borrow $5 for the school bake sale?' In the past, I might have said yes without thinking, or said no and felt guilty. This time, I said, 'Let’s look at your spending this week.' We opened the app together and saw she’d bought two drinks and a snack after dance class. 'I didn’t realize I spent that much,' she said. 'Do you want to borrow it, or wait until next week?' She chose to wait. That conversation wouldn’t have happened without the app. It gave us a shared reference point—calm, clear, and free of emotion.

Even our kids started bringing up money in new ways. My son asked, 'Why do we pay more for electricity in summer?' Instead of giving a long lecture, I showed him the bill history in the app. 'See how it goes up when we use the AC?' He nodded. 'Can we set a goal to use less?' We did. We created a small family challenge: keep the bill under a certain amount for three months. The app tracked it, and we celebrated when we succeeded. It wasn’t about cutting comfort—it was about awareness. And that awareness brought us closer. We weren’t just a family living under one roof. We were a team making choices together.

Teaching Kids Financial Awareness—Without the Lecture

As parents, we all want our kids to grow up smart with money. But how do you teach that without sounding like a nag? I tried charts, piggy banks, even a fake 'family store' once. Nothing stuck. The spending reminder app changed that. It didn’t replace teaching—it made teaching easier. Because the lessons came from real life, not a lecture.

Take my daughter’s birthday money. She got $50 from relatives and was so excited. In the past, it would have disappeared in a week—on stickers, candy, random toys. This time, I helped her set up a 'Birthday Fund' in the app. She got a notification every time she spent from it. After her third purchase, she paused. 'I only have $18 left,' she said. 'I thought I had more.' That was the moment. No scolding, no 'I told you so.' Just a quiet realization. She started asking, 'Is this worth it?' 'Can I wait?' That’s financial awareness in action.

We started using the app to set small goals. She wanted a new backpack—$45. We set a reminder: 'Backpack Goal: $45. Current: $22. 51% saved.' Every time she added money, the app celebrated it with a little animation. She loved that. She started doing extra chores to reach it faster. When she finally bought it, she held it like a trophy. 'I saved for this myself,' she said. That pride? That’s priceless. The app didn’t create the goal—it just made the progress visible. And visibility builds confidence.

What I love most is that the app doesn’t judge. It doesn’t say, 'Bad spending!' It just shows what happened. And that objectivity makes it safe for kids to learn. They can make small mistakes—like spending too fast—and see the result without shame. They learn cause and effect in a gentle way. And because we’re all using it, they see us making choices too. They hear us say, 'Let’s wait on that upgrade until next month,' or 'We’re saving for vacation, so no extra takeout.' It’s not perfection. It’s practice. And practice, over time, becomes wisdom.

Saving Time, Reducing Stress, and Gaining Peace of Mind

Let’s talk about time. As a mom, I know how precious it is. Between work, school runs, meals, and bedtime routines, every minute counts. Before the app, I’d spend at least an hour a week just tracking down due dates, checking balances, and reminding everyone about payments. Now, it takes 15 minutes. The app does the heavy lifting. It tracks, reminds, and updates—so I don’t have to.

But the real gift isn’t time saved. It’s peace of mind. I no longer wake up wondering if I missed something. No more heart drops when an unexpected charge appears. The app doesn’t eliminate financial decisions—but it removes the panic. Now, when a bill comes up, I can say, 'We’ve got this,' instead of 'Oh no, again?' That shift in mindset is huge. It’s the difference between feeling overwhelmed and feeling capable.

I’ve also noticed something deeper: less mental clutter. Our brains can only hold so much. When money is constantly nagging in the background, it steals energy from everything else—our patience, our joy, our presence with our kids. With the app handling the reminders, that noise has quieted. I have more space to listen, to laugh, to just be. Last weekend, we had a picnic in the park. No phones, no stress. Just us. And I realized—I wasn’t secretly worrying about bills. I was fully there. That’s the real win.

Even my husband has changed. He used to dread financial conversations. Now, he checks the app on his own. 'Looks like we’re on track for the car repair fund,' he’ll say. Or, 'The kids’ summer activities are looking good—budget’s balanced.' That sense of control has brought him calm too. We’re not perfect. We still make impulse buys, still debate purchases. But now, we do it with more awareness, more kindness, and far less stress.

More Than an App: Building a Smarter, Closer Family

Looking back, I never thought a simple app could change so much. It wasn’t about cutting spending or tracking every penny. It was about creating a shared language around money—one built on transparency, trust, and care. The reminders didn’t just alert us to bills. They reminded us to talk, to plan, to support each other.

What started as a tool for efficiency became a bridge for connection. We stopped seeing money as a source of tension and started seeing it as a way to work together. Our kids learned responsibility not through punishment, but through practice. We saved time, yes—but more importantly, we saved emotional energy. That energy? We poured it into each other.

These days, when I see a notification pop up, I don’t sigh. I smile. Because I know it’s not just a reminder—it’s a small act of love. A way of saying, 'I’ve got your back. We’re in this together.' In a world that often feels chaotic, that sense of teamwork means everything. So if you’re struggling with money stress at home, I’ll say this: try a spending reminder app. Not because it’s perfect, but because it might just be the quiet nudge your family needs. Sometimes, the simplest tools bring the deepest rewards. And in our case, it wasn’t just about better budgets. It was about a better family life.